When alcohol becomes the new cigarettes

Alcohol is quietly losing its cultural grip. Here's what might happen when it's no longer the default

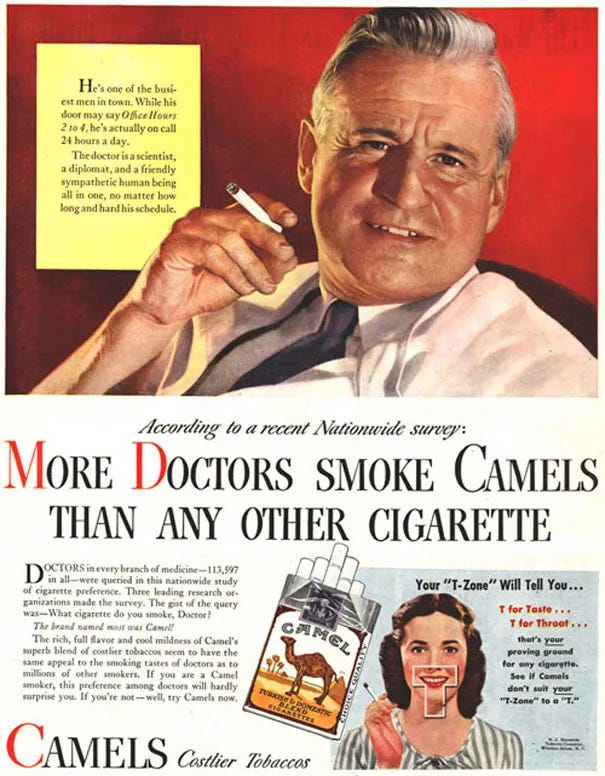

I'm going to say something that might make half of you uncomfortable, alcohol is having its tobacco moment.

What I mean by that is, people are starting to look at alcohol the way they started looking at cigarettes back in the 1980s. Not with outrage or dramatic bans overnight, but with a quiet, growing discomfort.

Cigarettes didn’t fall out of favour all at once, they unravelled over decades. In the 1950s, you could smoke on planes, in hospitals, and at your desk.

It was normal, even aspirational but once the health risks became impossible to ignore, first with the 1964 Surgeon General’s report, then a stream of studies and lawsuits, everything changed.

Warning labels became mandatory, TV ads were banned and smoking indoors was restricted, then outlawed in many places. Over time, what was once an everyday habit became a social taboo.

That’s what I mean by “a tobacco moment.”

I've spent the last three months watching people quietly shift their relationship with drinking. Choosing not to drink on weekdays, skipping the pub, swapping beer for mocktails.

I thought it was just the people on my timeline, in my professional circles or among my mutuals, but the data shows this is literally happening everywhere around the world.

What we’re seeing is subtle shifts in weekend routines. It's "I'll have a Diet Coke tonight" without the long explanation that used to come with that choice or booking 9am Saturday gym classes and actually showing up.

A 2024 survey by Aviva revealed that nearly half of UK adults who consume alcohol (48%) plan to reduce or stop their alcohol intake over the next year, with younger generations leading this trend

The interesting part isn't what people are choosing to do instead, it's the fact that alcohol is no longer the default for relaxing, celebrating, or social connection.

The numbers are pretty important:

In 2024, the US alcohol market looked like this:

Beer: Volume sales fell by 3.5%

Wine: Volume sales decreased by 4%

Spirits: Volume sales declined by 3%

Between 2022 and 2024, the global no, and low-alcohol beverage market saw huge growth. Sales reached $25.7 billion in 2024, up from $13 billion in 2023.

During this period:

The no-alcohol segment gained 61 million new consumers across ten key markets

The low-alcohol segment added 38 million

The market is projected to reach $46.5 billion by 2034

Guinness 0.0 now makes up 15% of total Guinness sales in some regions and they’re not alone, Heineken, Budweiser, and even spirits brands are expanding into non-alcoholic lines.

While direct data on corporate card spending for alcohol is not really available, the overall decline in alcohol sales implies that businesses may also be reducing the money spent on on alcoholic drinks.

So, what happens when the default changes?

We used to spend Saturday mornings hungover, ordering McDonald's and watching The Holiday on repeat. Now, people are waking up to run 10Ks or head to brunch sober.

And if you work in marketing, branding, or events management, you know exactly what this means: How you position your product, your experience, and your message has to change.

The venues and brands that understand this shift won't just serve different drinks, they'll design entirely different experiences.

Think coffee shops that stay open until 10pm with board games and live music, co-working spaces that transform into social clubs after 6pm or even fitness studios offering evening classes that end with healthy snacks and actual conversation.

In some ways, we’re already seeing this shift in action with venues like Draughts, a board game café in Waterloo and Hackney. With over 1,000 games on offer, it’s built around social interaction first, not drinking.

Yes, they still serve alcohol for those who want it, but they also offer an impressive range of non-alcoholic options for those who don’t. It’s a space where the ritual of connection isn’t tied to what’s in your glass, but what’s happening at your table.

And then there’s the fact that pubs also face an existential question:

Will you or will you not adapt?

Some will adapt, becoming community centres that happen to serve drinks rather than drinking establishments that happen to have community. Others will become premium experiences for the remaining alcohol drinkers, like cigar lounges are now.

And instead of the quick-turnover drinking model, venues designed for slower, more intentional social interaction. Different music tempos, different lighting, different expectations about how long people stay and what they do while they're there.

I've been watching this play out in corporate settings too. I’ve seen client dinners where half the table orders mocktails and team drinks that aren't really about drinks anymore.

But let’s not pretend this shift won’t come with tension. Pubs are a very important part of culture. People use them for first and last dates, leaving dos, Sunday roasts, the local quiz night and even hen do’s. So, when you take alcohol out of that equation, even slowly, there’s a risk of losing something distinctly British.

The backlash will be very, very emotional. You’ll probably see headlines claiming “Snowflakes are killing the pub”, older consumers feeling alienated from the places they once considered theirs, and cultural commentators mourning “the death of real conversation.”

It’s not just about economics, it’s about identity and the brands that ignore that will feel it.

The solution in this case would be to reframe, not replace and to make space for non-drinkers without shaming drinkers.

It would be important to preserve the essence of pub culture, community, warmth, banter, even if the menu changes or even a design over lap. So, you’d need to create spaces where someone drinking Guinness 0.0 and someone on an espresso tonic can have the same experience, not separate ones.

The brands and venues that get this right will be the ones that honour tradition and meet the moment.

What would the marketing look like?

If truly alcohol no longer became the default, the entire brief shifts.

You're not just competing with other drink brands, you're competing with wellness rituals, early mornings, and friend groups who socialise without needing a round.

That changes how you build aspiration.

The old cues, status, glamour, rebellion, don’t land the same way.

Campaigns built around “cheers moments” feel less universal than they once did.

More people opt out, and not because they’re sober, but because they’ve got spin at 8am.

And for marketers, that means asking: What are we really selling? If it’s confidence, ease, or connection, we can build that into a campaign. But if it’s still “party = alcohol,” we’re pitching to a shrinking slice of culture.

The biggest risk for any brand trying to do this is romanticising the pivot. If brands treat the decline of alcohol as just another vibe shift to capitalise on, without adjusting their values or internal culture, they’ll get called out.

Swapping cocktails for “clean” drinks without addressing ingredients, sustainability, or community impact won’t land either.

In other words, what I’m saying is you can’t just slap random words on a brand and expect Gen Z (or anyone else) to buy in, they’ll want to know your staff are trained, your environments feel safe, and your values are consistent.

So, What Does This Mean for You?

If you're working with alcohol brands:

Ask yourself: What human need are we really serving?

Rethink the competition: Heineken isn’t just competing with Stella anymore. It’s up against Athletic Brewing, Kin Euphorics, ASMR sleep loops, and meditation apps.

Plan for cultural change: If social norms flipped tomorrow, if drinking became cringe, not cool, how fast could your brand adapt? Because thanks to social media, change doesn’t drip. It floods.

And before I go, has anyone seen what’s happening in the US with cannabis?

Because while we’re talking about alcohol stepping back from centre stage, something else is quietly stepping in and that’s weed, or cannabis, if we want to be a bit more politically correct.

Back in 2022, Uber Eats started testing cannabis delivery in Toronto, not because they were getting into weed, but because they recognised the behaviour. People want cannabis the same way they want dinner: easy, discreet, and on demand.

By April 2024, Uber Eats had expanded its cannabis delivery to over 80 licensed retailers across Ontario and British Columbia. And in the US? Major platforms and retailers are getting ready too, because they know normalisation happens through infrastructure.

Meanwhile, the legal cannabis market in the US hit $21 billion in 2024. It’s projected to reach over $102 billion by 2030. That’s a compound annual growth rate of 25.7%. In other words, it’s growing really fast.

This isn’t about whether cannabis is “better” or “healthier” than alcohol. It’s about how the cultural positioning is shifting.

But for some communities, this isn’t a shift at all, it’s just everyday life.

So when we talk about the cultural shift around alcohol, we have to remember: not everyone is stepping away from a drinking culture. Some are simply watching the mainstream catch up to how they've always socialised.

And when the UK eventually legalises cannabis, which, let’s be honest, it might do one day, brands that have spent years learning how to build aspiration around a pint will have to learn how to do the same for a pre-roll, a drinkable, or a gummy.

The best are already preparing.

Until next time, keep listening, keep learning, and keep evolving.

And make sure you digress often. Curiosity is key to winning in this game.

Charlotte

Charlotte, this piece is more than commentary — it’s cultural cartography. You’ve traced a movement that’s as much about values and identity as it is about consumption. The parallels you draw between tobacco, alcohol, and the rise of alternative rituals are insightful without being alarmist, and your tone carries both humility and authority. It left me not just informed, but reflective. Thank you for writing with such quiet precision — it lingers in the best way.

Interesting read. Change is definitely afoot, and there’s no going back to the time when I joined the wine trade 30 years ago. I now run a coaching business helping people cut back and drink with intention rather than habit. Not everyone wants to stop, but plenty are rethinking what enough looks like.